TORONTO, May 25, 2016 /CNW/ - Sulliden Mining Capital Inc. ("Sulliden" or the "Company") (TSX: SMC) is pleased to announce the completion of a mineral resource estimate for the past-producing Troilus Mine, located in the Abitibi mining region of Quebec, Canada.

The mineral resource estimate, completed by Roscoe Postle Associates Inc. ("RPA"), is based on high quality historical drill data and was generated with a focus on a potential underground mining scenario. Highlights from the updated mineral resource estimate are as follows (see tables 1, 2, and 3 for details):

Underground Indicated Mineral Resources:

29.6 Mt containing 1.4 Moz of gold grading 1.48 g/t and 102 Mlbs of copper grading 0.16%, resulting in 1.6 Moz gold equivalent grading 1.72 g/t gold equivalent.

Total (Open Pit and Underground) Indicated Mineral Resources:

44.0 Mt containing 1.8 Moz of gold grading 1.27 g/t and 117 Mlbs of copper grading 0.12%, resulting in 2.1 Moz gold equivalent grading 1.45 g/t gold equivalent.

Justin Reid, CEO and director of Sulliden, commented, "We believe this updated mineral resource estimate will be a solid foundation for our planned engineering and technical studies. As a number of former technical reports on the Troilus project conclude, there are significant open pit and underground mineral resources remaining at Troilus, and we look forward to exploring the future potential mining scenarios of this project."

Please see Sulliden's press release dated May 2, 2016 that describes the terms of the option arrangement pursuant to which Sulliden has a right to acquire an interest in the Troilus Project.

Table 1 - Underground Mineral Resources (as at April 22, 2016)

| Classification |

Zone |

Tonnage

(Mt) |

Au

(g/t) |

Cu% |

AuEq

(g/t) |

Contained

Gold

(000 oz) |

Contained

Copper (Mlb) |

Contained

AuEq

(000 oz) |

| Indicated |

Z87 |

29.6 |

1.48 |

0.157 |

1.72 |

1,403 |

102.2 |

1,635 |

| J4 |

- |

- |

- |

- |

- |

- |

- |

| J5 |

- |

- |

- |

- |

- |

- |

- |

| Total Indicated |

|

29.6 |

1.48 |

0.157 |

1.72 |

1,403 |

102.2 |

1,635 |

| |

| Inferred |

Z87 |

7.9 |

1.19 |

0.138 |

1.41 |

305 |

24.2 |

360 |

| J4 |

4.4 |

1.15 |

0.040 |

1.21 |

163 |

3.9 |

172 |

| J5 |

0.3 |

0.98 |

0.045 |

1.05 |

10 |

0.3 |

11 |

| Total Inferred |

|

12.6 |

1.18 |

0.102 |

1.33 |

478 |

28.4 |

543 |

Notes: 1. CIM definitions were followed for mineral resources.

2. Mineral resources were estimated at a cut-off grade of 0.8 g/t Au.

3. Mineral resources were estimated using long-term metal prices of US$1,500 per ounce gold and US$3.50 per pound copper; and an exchange rate of US$1.00 = C$1.1.

4. AuEq = (34.59 * Au Grade + 54.02 * Cu grade)/ 34.59

5. A recovery of 83% was used for gold and 92% for copper.

6. Numbers may not add due to rounding.

7. Other than the receipt of necessary permits and ongoing reclamation obligations, Sulliden does not know of any material legal, political, environmental or other factors that could affect the development of the project. |

Table 2 - Open Pit Mineral Resources (as at April 22, 2016)

| Classification |

Zone |

Tonnage

(Mt) |

Au

(g/t) |

Cu% |

AuEq

(g/t) |

Contained

Gold

(000 oz) |

Contained

Copper (Mlb) |

Contained

AuEq

(000 oz) |

| Indicated |

87 |

- |

- |

- |

- |

- |

- |

- |

| J4 |

12.2 |

0.84 |

0.044 |

0.91 |

329 |

11.8 |

356 |

| J5 |

2.2 |

0.80 |

0.052 |

0.88 |

57 |

2.5 |

63 |

| Total Indicated |

|

14.4 |

0.83 |

0.045 |

0.90 |

386 |

14.3 |

419 |

| |

| Inferred |

Z87 |

- |

- |

- |

- |

- |

- |

- |

| J4 |

2.9 |

0.85 |

0.043 |

0.92 |

81 |

2.8 |

87 |

| J5 |

0.7 |

0.78 |

0.059 |

0.87 |

18 |

0.9 |

20 |

| J4 Low |

2.5 |

0.56 |

0.049 |

0.64 |

45 |

2.7 |

51 |

| Total Inferred |

|

6.1 |

0.73 |

0.048 |

0.81 |

144 |

6.4 |

158 |

Notes: 1. CIM definitions were followed for mineral resources.

2. Mineral resources were estimated at a cut-off grade of 0.3 g/t Au and were constrained by a Whittle pit shell.

3. Mineral resources were estimated using long-term metal prices of US$1,500 per ounce gold and US$3.50 per pound copper; and an exchange rate of US$1.00 = C$1.1.

4. AuEq = (34.59 * Au Grade + 54.02 * Cu grade)/ 34.59

5. A recovery of 83% was used for gold and 92% for copper.

6. Numbers may not add due to rounding.

7. Other than the receipt of necessary permits and ongoing reclamation obligations, Sulliden does not know of any material legal, political, environmental or other factors that could affect the development of the project. |

Table 3 - Total Open Pit and Underground Mineral Resources (as at April 22, 2016)

| Classification |

Tonnage

(Mt) |

Au

(g/t) |

Cu% |

AuEq

(g/t) |

Contained

Gold

(000 oz) |

Contained

Copper (Mlb) |

Contained

AuEq

(000 oz) |

| Total Indicated |

44.0 |

1.27 |

0.120 |

1.45 |

1,789 |

116.5 |

2,054 |

| |

| Total Inferred |

18.7 |

1.03 |

0.084 |

1.16 |

622 |

34.8 |

701 |

Notes: 1. CIM definitions were followed for mineral resources.

2. Open pit Mineral Resources were estimated at a cut-off grade of 0.3 g/t Au and were constrained by a Whittle pit shell. Underground Mineral Resources were estimated at a cut-off grade of 0.8 g/t Au.

3. Mineral Resources were estimated using long-term metal prices of US$1,500 per ounce gold and US$3.50 per pound copper; and an exchange rate of US$1.00 = C$1.1.

4. AuEq = (34.59 * Au Grade + 54.02 * Cu grade)/ 34.59

5. A recovery of 83% was used for gold and 92% for copper.

6. Numbers may not add due to rounding. |

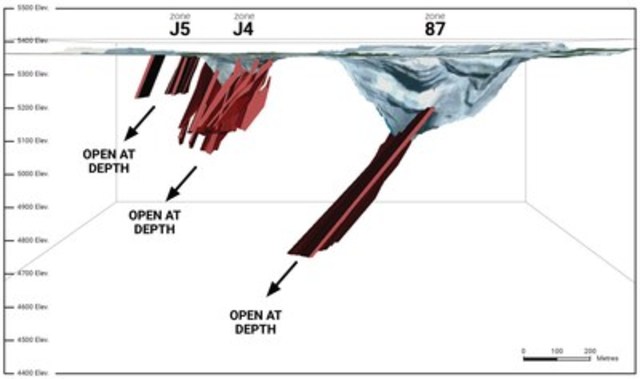

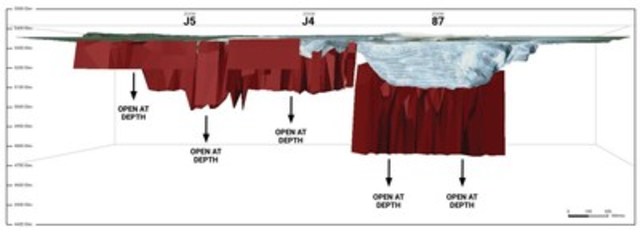

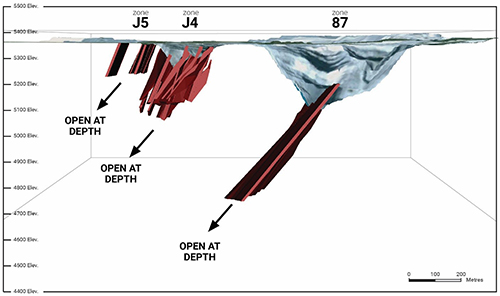

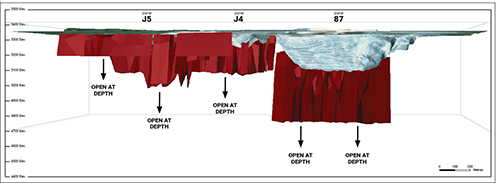

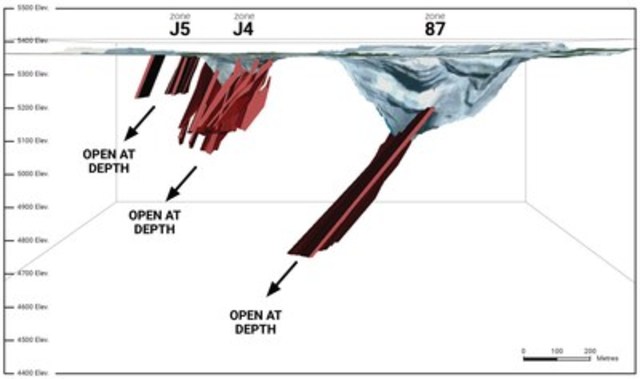

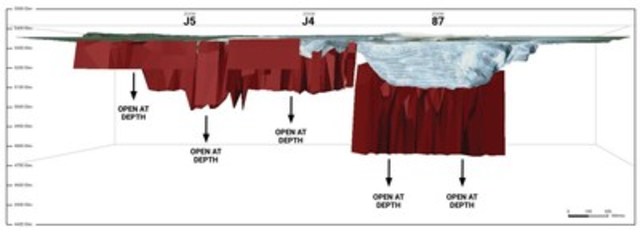

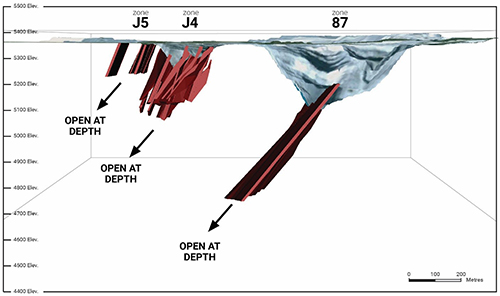

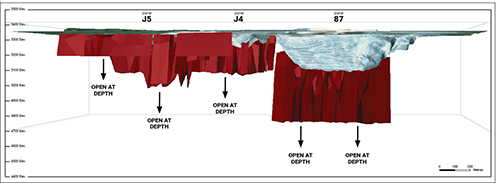

Estimation Methodology - Zones J4 and J5

The J4 and J5 zones (see location in Figures 1 and 2) were modelled using grade shell wireframes interpreted at 0.3 g/t Au and 0.8 g/t Au thresholds for open pit and underground resources respectively. Assays were capped to 10 g/t Au prior to compositing to three metre lengths. Grades were interpolated using inverse distance squared with the search geometry and orientation customized by zone. A factor of 2.786 t/m³ was used to convert volume to tonnage. Open pit resources were modelled using a 5 m by 5 m by 5 m percent block model built in Geovia GEMS 6.6 software reported inside a Whittle pit shell. One low grade domain was also included for the J4 zone which captures a small amount of narrower and less continuous mineralization located outside the modelled mineralized wireframes. The underground resource estimate reports all blocks within the 0.8 g/t Au grade shells.

Estimation Methodology - Zone 87

The 87 zone (see location in Figures 1 and 2) underground mineral resources are based on the 2006 10 m by 10 m by 10 m percent underground block model originally built in Gemcom 4.02 and later converted to Geovia GEMS 6.7.2. The Zone 87 drill hole database contains 645 drill holes totalling 127,454 m and 70,435 assays. There has been no drilling since 2006. The drill hole intersections are spaced approximately 50 m to 100 m apart. The 87 Mineral Resource estimate reports all blocks within a set of wireframes interpreted at a 0.8 g/t Au grade threshold below the current topographic surface.

A tonnage factor of 2.86 t/m³ was used based on 496 measurements.

Qualified Person

The mineral resource estimate was prepared and reviewed by Mr. Luke Evans, Executive Vice President, Geology and Resource Estimation, Principal Geologist at RPA. Mr. Evans is an independent Qualified Person in accordance with the requirements of National Instrument (NI) 43-101 and has approved the scientific and technical disclosure herein. A Technical Report authored by Mr. Evans will be filed on SEDAR within 45 days of this news release.

About Sulliden Mining Capital

Sulliden is a Canadian venture capital company focused on the acquisition and development of quality mining projects in the Americas, in addition to identifying opportunities for active investments.

Sulliden Mining Capital Inc.

On behalf of the Board

"Justin Reid"

Chief Executive Officer & Director

Caution regarding forward-looking information:

This press release contains "forward looking information" within the meaning of applicable Canadian securities legislation. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information includes mineral resource estimates; future technical and engineering studies, their results and timetables; statements regarding reclamation obligations and mineral price projections, among other things. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; other risks of the mining industry and the risks described in the public disclosure documents of the Company. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE Sulliden Mining Capital

Image with caption: "Figure 1 – 3D Section of Troilus Zones 87, J4 and J5, Looking North (CNW Group/Sulliden Mining Capital)".

Image with caption: "Figure 2 – 3D Section of Troilus Zones 87, J4 and J5, Looking East (CNW Group/Sulliden Mining Capital)".

Caroline Arsenault, Corporate Communications, +1 (416) 861-5805 Copyright CNW Group 2016